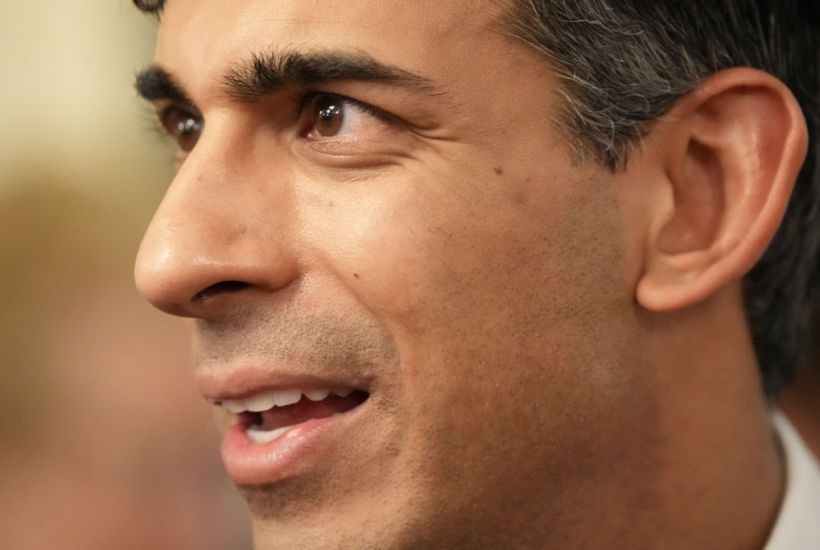

Rishi Sunak seems to have a New Year’s resolution: to claim that taxes are falling and say it so often that people start to believe him rather than their own lying payslip. He says that the last Budget was the biggest tax-cutting event since the 1980s, etc. He tells today’s Sunday Telegraph that more welfare reform will allow him to cut taxes even more.

Already a subscriber? Log in

Subscribe for just $2 a week

Try a month of The Spectator Australia absolutely free and without commitment. Not only that but – if you choose to continue – you’ll pay just $2 a week for your first year.

- Unlimited access to spectator.com.au and app

- The weekly edition on the Spectator Australia app

- Spectator podcasts and newsletters

- Full access to spectator.co.uk

Or

Comments

Don't miss out

Join the conversation with other Spectator Australia readers. Subscribe to leave a comment.

SUBSCRIBEAlready a subscriber? Log in