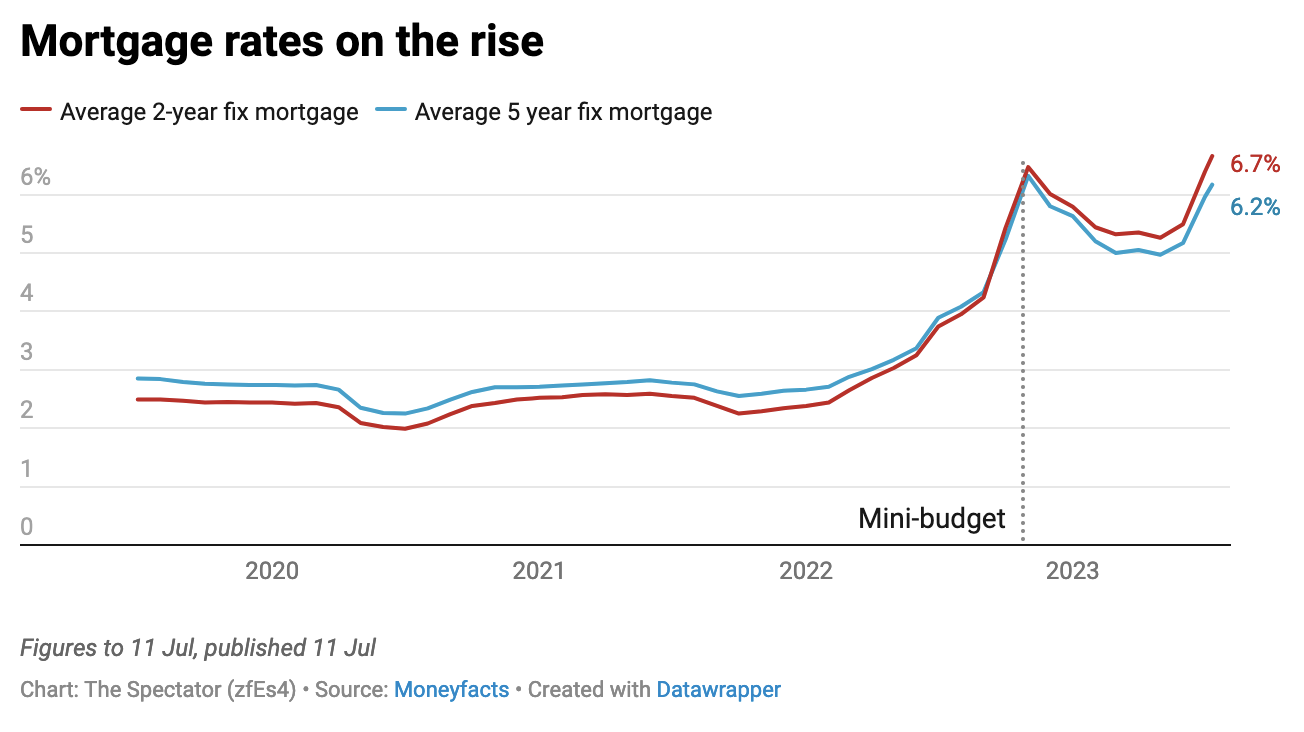

Mortgage costs have reached a 15-year high today, with the average two-year fixed deal hitting 6.66 per cent – the highest level since the summer of the 2008 financial crash. But today’s mortgage news is being pegged to far more recent history, as average deals just topped their peak from last autumn, when Liz Truss’s mini-Budget sent interest rate expectations soaring, and mortgage offers along with them.

Truss’s premiership came to an end because so many numbers were spiralling upward, including the cost of government borrowing, mortgage repayments, and the number of Tory MPs who – amid all the chaos –...

Already a subscriber? Log in

Get 10 issues

for $20

Subscribe to The Spectator Australia today for the next 10 magazine issues, plus full online access, for just $20.

- Delivery of the weekly magazine

- Unlimited access to spectator.com.au and app

- Spectator podcasts and newsletters

- Full access to spectator.co.uk

Comments

Don't miss out

Join the conversation with other Spectator Australia readers. Subscribe to leave a comment.

SUBSCRIBEAlready a subscriber? Log in