Don’t bring a bottle. Your chances of finding a party in full swing down those chilly corridors are close to zero. At most, you might hear the sound of a distant flute playing a couranteby Lully. As Sir Howard Davies puts it in this insider’s view, which manages to be both authoritative and quite cheeky:

The Treasury does not cultivate a warm and cuddly working environment. You may well not know if your immediate boss has a spouse or partner, and would certainly never meet them if they exist. Social events are at a premium.

Yet this notoriously ascetic culture is not in the least hierarchical. Junior principals are free to slap down the arguments of the permanent secretary (Treasury officials seconded to city banks are startled by the silence of underlings in meetings there). The Treasury takes its officials from the forcing houses of Winchester and Manchester Grammar School, and in no time these intensely able recruits are making serious policy. As well as being so unexpectedly youthful, this Praetorian Guard of Whitehall is also thin on the ground. In the 1980s, I remember once asking for the names of the team supervising the nationalised industries (then a huge chunk of the British economy) and was amazed when I was directed to a single harassed under-secretary.

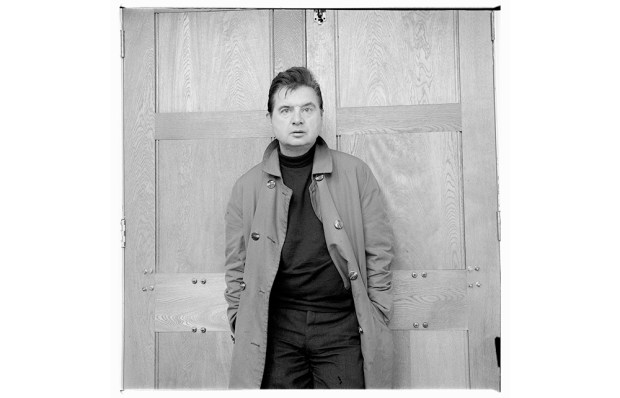

The Chancellors is a sequel to Davies’s earlier book The Chancellors’ Tales (2006), which included lectures given at the LSE by the five living ex-chancellors who ran the British economy between 1974 and 1997. Now he takes the story forward, drawing on his interviews with the four who were in charge for most of the period between 1997 and 2019, this time telling the story himself.

When I say this is an insider’s view, that’s an understatement. Davies keeps popping up in his own narrative, at first in the Foreign Office, then in the Treasury, then as controller of the Audit Commission, then as director general of the CBI, on to the Bank of England as deputy governor, from there to chair the new Financial Services Authority, and out of Whitehall again to run the LSE. He is everywhere, the Zelig of the public finances. So he constantly has to be marking his own homework; but such is the marvellous moral austerity of a good Treasury man, you always feel he is recording the failures on his watch as candidly as the successes.

On overall performance during the period, Davies gives the UK economy reasonably high marks, well up with the leading developed nations. Only in the years after the EU referendum has the UK fallen behind. We can leave it to the Brexotics and the Remoaners to argue whether this is a temporary ‘kerfuffle’, to use Boris Johnson’s preferred term for making light of serious things, or a permanent loss of trade.

But the statistics should not mislead us into thinking that it has been a smooth patch in the Treasury’s history. During these two decades, it has been threatened with break-up at least twice; lost one of its most important functions to the Bank of England; sharply reversed macro-economic policy at least twice; was instrumental in saving one referendum and no less instrumental in losing another; failed to foresee one global financial crisis and retrieved stability only at the eleventh hour.

Davies reminds us how Gordon Brown deserted Prudence, who had been his constant companion throughout Labour’s first term, for a dramatic spending splurge which transformed Britain’s schools and hospitals and hugely reduced working poverty, bringing a real gain of 17 per cent in the incomes of the poorest as against only 1 per cent for the top earners. But then, as the invaluable Institute for Fiscal Studies points out, this had been pretty much the same story under Margaret Thatcher: continence with Geoffrey Howe, expansiveness with Nigel Lawson.

You can go further back and see a similar pattern under Edward Heath, from Iain Macleod’s short-lived tenure to the Barber Boom; and twice under Harold Macmillan – Peter Thorneycroft and Selwyn Lloyd both being forced out to make way for the more compliant Derick Heathcoat-Amory and Reggie Maudling. The need to win the next election always takes priority. If Johnson survives, Rishi Sunak may suffer the same fate as his fellow Wykehamist Geoffrey Howe. Wykehamists make great chancellors (Stafford Cripps, Hugh Gaitskell), but are not quite vulgar enough to make it to the very top, the sole exception being Henry Addington, who was no great shakes.

The term ‘mandarin’ suggests a high-minded indifference to low politics. In the case of the Scottish referendum, nothing could be further from the truth. The Treasury permanent secretary, Nick MacPherson, argued passionately for the Union, insisting that a truly independent Scotland would be shattered by its first bank crash. One senior official described the publication of his damning verdict as ‘the most extreme politicisation in the Treasury’s history’. The cabinet secretary, Jeremy Heywood, tried to veto the publication, but George Osborne supported MacPherson. Alistair Darling, who led the Better Together campaign, concluded that ‘it was the economics what won it’.

I like the sound of the forthright MacPherson. He described NHS Test and Trace, estimated to cost £37 billion, as ‘the most wasteful and inept public spending programme of all time’. High praise indeed, as Davies remarks. But the failure to supervise the banks must have cost many billions more. It will be a long time before Ed Balls lives down his boast when minister for the City in 2006 that ‘today our system of light-touch and risk-based regulation is regularly cited as one of our chief attractions’. Davies also describes a war game that same year, in which the assembled regulators considered the case of a northern building society heavily dependent on wholesale funding of its mortgage book – which was to be precisely Northern Rock’s trouble two years later. Unfortunately, the regulators could not agree what they should do in such a case, and so do did nothing.

The story of the Treasury and the EU is even more contentious, and surprising. When Davies joined the Treasury in 1976, just after being the only man in the Paris embassy to have voted ‘No’ in the first referendum, he was surprised to find Great George Street a home from home. The department had always been suspicious of foreign entanglements, regarding itself as a cut above, a feeling intensified after the ERM debacle of 1992. Brown and Balls masterminded a devious and brutal campaign to keep Britain out of the euro. (Ironically, Davies himself, by then at the CBI, had cast off his youthful enthusiasm for glorious isolation and was now all in favour of going in.) They kept Tony Blair out of the loop, in what Balls later admitted was ‘one of the more heavy-handed and uncollegiate things that I was ever involved in’.

How and why the Treasury then became convinced Europeans en masse remains something of a mystery, even to Davies. But by the time of the 2016 referendum, the Treasury had become Public Enemy No. 1 of the Vote Leave campaign. It was the Treasury which had declared that ‘the UK would be permanently poorer if it left the EU’, and Osborne who led ‘Project Fear’ (the phrase was actually coined, not by Johnson, but by Alex Salmond in the Scottish referendum). The irony was that the Treasury’s original long-term forecast that the impact of leaving would reduce GDP by about 4 per cent still looks reasonably accurate. It was Osborne’s second paper, a month later, which forecast ‘an immediate and profound shock to our economy’ and prompted him to promise an emergency budget if Britain left, in order to tackle ‘the £30 billion black hole’ in the nation’s finances. This doomsday scenario was wildly wrong, as Osborne himself now admits, resting as it did on the implausible assumption that the Bank of England would take no action to steady the ship.

The howler seriously damaged the Treasury’s reputation. Brexiteers like Iain Duncan Smith wanted the Treasury broken up. So did Ed Miliband for a while. He commissioned a review from Lord Kerslake, the former head of the Home Civil Service, who described the Treasury as ‘arrogant, overbearing and negative’. Lionel Barber, then editor of the Financial Times, described the department as ‘devalued currency’. When Dominic Cummings burst on the scene, he attempted a coup by persuading Johnson to insist that Sajid Javid sack his own advisers and accept No. 10’s nominees, but was foiled by Javid’s refusal to be humiliated. After 20 years of turmoil, Davies reflects at the end of his unfailingly lively tour, ‘the Treasury was as powerful as it was at the start’. Attempts to create a rival centre of economic policy-making had all failed, and the spending departments continued to do as they were told, meekly accepting their annual settlements.

And a good thing too. Effective control of the purse strings is the first thing we expect from government. I disagree with Davies only where he deplores the skeleton staff of the department. I fear that if the numbers were much increased, sooner or later they would start thinking of more ways of spending our money – as they are already doing in the vastly inflated No. 10. Treat ’em mean, keep ’em keen.

Got something to add? Join the discussion and comment below.

Get 10 issues for just $10

Subscribe to The Spectator Australia today for the next 10 magazine issues, plus full online access, for just $10.

You might disagree with half of it, but you’ll enjoy reading all of it. Try your first month for free, then just $2 a week for the remainder of your first year.

Comments

Don't miss out

Join the conversation with other Spectator Australia readers. Subscribe to leave a comment.

SUBSCRIBEAlready a subscriber? Log in